It’s one of the biggest mistakes that a Real Estate Investor can make: Buying a rental property without running the numbers first.

So many Real Estate Investors are putting their personal finances at risk by buying a property without understanding what they’re getting into. We see it again and again and it causes so much stress for the soon-to-be Landlord.

According to a 2023 study conducted CIBC and Urbanation, 52% of rental properties in Ontario were cashflow negative, meaning there isn’t enough rental income to cover the monthly expenses. This figure is likely even higher in 2024, as more mortgages have renewed (at a higher mortgage rate) and more new-build rental units have come online (at high purchase prices).

This is shocking! Whatever happened to the fundamentals of real estate investing?

Like many aspiring real estate investors, I first learned the fundamentals by reading ‘Rich Dad, Poor Dad’ and other books by Robert Kiyosaki. The Rich Dad philosophy taught the four fundamentals of real estate investing, the most critical ones being:

#1 – The investment must put money in your pocket.

#2 – The investment must stand alone.

This seems like common sense, but somehow investors are ignoring the obvious and getting themselves stuck in a difficult situation.

Why does this happen?

FOMO – Fear of Missing Out

Real Estate Investing became trendy after the 2008 financial crisis. At the time, it was easy to buy a rental property and have it cashflow from the beginning. That all changed by 2017, when housing prices reached a threshold where it was becoming difficult to achieve cashflow on a new rental property.

Since that time, things have gotten even worse. Low interest rates, increasing population and a shortage of housing supply have driven up home prices to the point where it’s nearly impossible to buy a property that cashflows. However, the real estate investing trend has continued unabated, with late-comers wanting to get in on the action (ie. FOMO – fear of missing out), while ignoring the fundamentals.

Problem is: when the dust settled, they found themselves with properties that were losing money each month, even though rental rates had also increased significantly.

We see so many new real estate investors that buy a property without first determining if the estimated rental rate will cover their costs. This seems like it should be common sense, but many people get caught up in the frenzy and excitement of buying a property and are basically hoping and praying that it will work out. It usually doesn’t.

Time-delay when buying a new-build

Another common scenario is that the property was bought off builder plans and the market changed during the 2-3 years that the buyer is waiting for the property to be built.

Realistically, there’s not much you can do to predict the expected rental rate or interest rates years down the road. In this case, the risk is difficult to mitigate. Best to be ultra-conservative when you run the numbers, so that you have some wiggle-room if rates aren’t what you planned.

Not understanding how the rental market works

Many new Landlords don’t understand that rental rates are market-driven, not cost-driven. In other words, it doesn’t matter what you paid for the house or what your property taxes are or how much your mortgage payment is, the maximum rental rate for the property is determined by what the market will bear, meaning what Tenants are willing and able to pay.

Not considering maximum affordability

Unlike home buyers, who have different strategies to stretch the affordability of a property (eg. Lower interest rates, larger down-payment, longer mortgage amortization), Tenants can only do so much to afford a higher rent payment. No matter what they do, there is a threshold of affordability by the time they pay for utilities, car payment, fuel, insurance, groceries, etc.

Real Estate Investors need to take this into consideration when buying a property. Best way to do this is ask yourself: How much rent would I be able or willing to pay for that property? Ask friends or family that are renting or have children that rent, how much they are paying or try to determine their maximum affordability. It’s always much less than you would expect. Again, it’s always best to be conservative with your estimates.

Other important considerations:

Real Estate might not be the best investment choice

Real estate may not be the best investment choice if you’re losing money every month. Sure, you might have long-term gains from Property Appreciation (or might not), but that is considered Speculation, not Investing.

Real Estate is generally considered a safe, long-term investment, but buying a rental property that’s losing money every month would be like buying stocks that are going down in value. It just doesn’t make sense.

You might be stuck with a financial burden

You should also remember that you could be stuck with your money-losing property. You might be locked into a fixed-term mortgage with substantial penalties for breaking it, or unable to sell the property because of market conditions or the substantial financial loss you would take because of Realtor Commissions, Land Transfer Tax paid, etc.

Your Tenants depend on your stability

When a Landlord is under financial strain, the Tenants will eventually be affected. This might start as an unwillingness to do repairs or a decline in the general upkeep of the property. The Landlord may also try to impose an unfair or illegal rent increase on the Tenant. If the financial strain persists long enough, the Landlord will eventually sell the property, which usually results in the Tenant being uprooted and evicted. It’s a lose-lose situation for everyone involved.

So, what should you do?

Do the Math

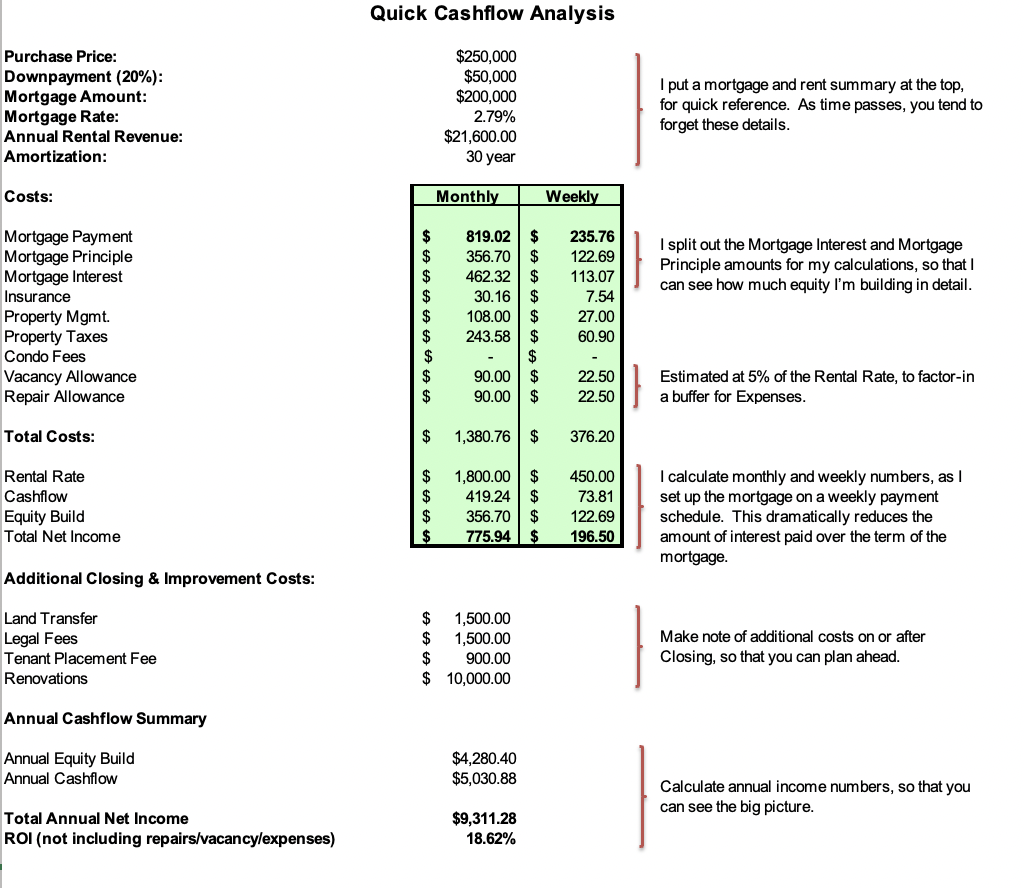

Before purchasing an investment property, you need to be certain that it will be cashflow positive. To do this, create a simple spreadsheet with your revenue and expenses, like the one below. This is the actual spreadsheet that I used for every rental property we purchased. If the numbers didn’t work, we didn’t buy the property.

Be real with your calculations

Always be on the conservative side with your estimates of rental income and expenses. Don’t base your calculations on the extremes, (high rental rates and low expenses). Find something in the middle that is reasonable and obtainable.

Plan for the worst-case scenario. No matter what you do, things will not always go as planned. You will have unexpected repairs, you will have vacancies, you will have larger capital expenditures (eg. Roof replacement, new furnace, new flooring, painting, etc.).

Look for properties with potential upside

Upside means that there is potential to improve the property as a way of increasing rental income. Here are a few ways to do that:

- Renovate to improve the quality of the property, to attract a higher-quality Tenant and higher rental rate.

- Add a secondary rental unit. For example, a legal Basement Apartment.

- Add an Accessory Dwelling Unit (ADU). This is a separate building on the property, if space permits. Many municipalities are fast-tracking approval of this type of structure, as a means of addressing the current housing shortage.

- Consider a Student Rental or a house that is suitable to rent by the room, as it’s possible to obtain higher total rental income.

If the numbers don’t work, don’t buy it

As a prerequisite, you want to make an educated buying decision without any surprises. A real estate investment shouldn’t have a negative impact on your personal finances. In fact, the whole purpose of investing is to enjoy the positive impact that the investment should have on your personal wealth.

If the investment property doesn’t meet these prerequisites, then don’t do it! Keep looking for options that will grow your wealth, not deplete it.

No comment yet, add your voice below!