The simple answer is Yes!

Many Landlords are indecisive when it comes to giving their Tenant an annual rent increase.

On one hand, their costs are going up every year, but on the other hand, they don’t want to rock the boat and risk losing a good Tenant.

I’ve been there. We were in the same situation with the Tenants at our first rental property. They were a fantastic young couple and took good care of the property. They paid their rent on time and were a pleasure to deal with, so we didn’t increase the rent for many years.

The problem is, eventually the rental rate is way behind the market rate. In our case, we were $500/month behind. Money’s not everything, but eventually you start looking at what you’re getting vs. what you could be getting. When it gets to that point, you kinda start wanting the Tenant to leave, even though they’re a great Tenant.

The Tenants finally gave notice to vacate after about 7 years of renting from us. I feel a little guilty in saying it, but we were glad that they were moving on, as we’d be able to get the property back up to market rent. They were fantastic Tenants, but it definitely would have been a better experience for us if we had increased the rent throughout the tenancy.

The lesson for me was: It’s important that a Landlord consider the needs of the Tenant and foster a positive Landlord-Tenant relationship (which we got right), but the Landlord also needs to balance that with protecting their own best interest, so that the relationship is mutually beneficial.

Reasons why Landlords choose not to give a Rent Increase

Fear of upsetting or losing a good Tenant

Many Landlords are happy with their nice, stable Tenants, so are hesitant to increase the rent because they don’t want to “rock the boat”. They fear losing the Tenant and the associated costs of finding a new Tenant, plus the risk of a vacancy or getting a bad Tenant next time.

The allowable increase percentage seems nominal

Landlords will also rationalize that the amount of the allowable rent increase (for most units in Ontario the maximum is 2.5% in 2024). However, you need to consider the long-term.

They don’t need the money

A great position to be in for sure, but still, the property is an asset and should be performing at peak capacity. The Landlord should consider Return on Capital and what it looks like if they ever decided to sell the property. A low rental rate could have a negative impact on the selling price.

Why you should give an increase

Your Expenses will increase every year

As the property owner, your costs will go up every year, guaranteed. Your Property Taxes, Insurance, Maintenance costs, and maybe even your borrowing costs will go up. That means that you’re essentially making less money as time goes by.

Keep up with market Rental Rates

Market rental rates generally trend upwards, so you can soon find that your rental rate is hundreds of dollars behind the market rate. Your Tenants will also see this and will be less likely to move out because their costs will be higher for the next rental unit. They know they have a good deal and will sit tight.

The Compounding Effect

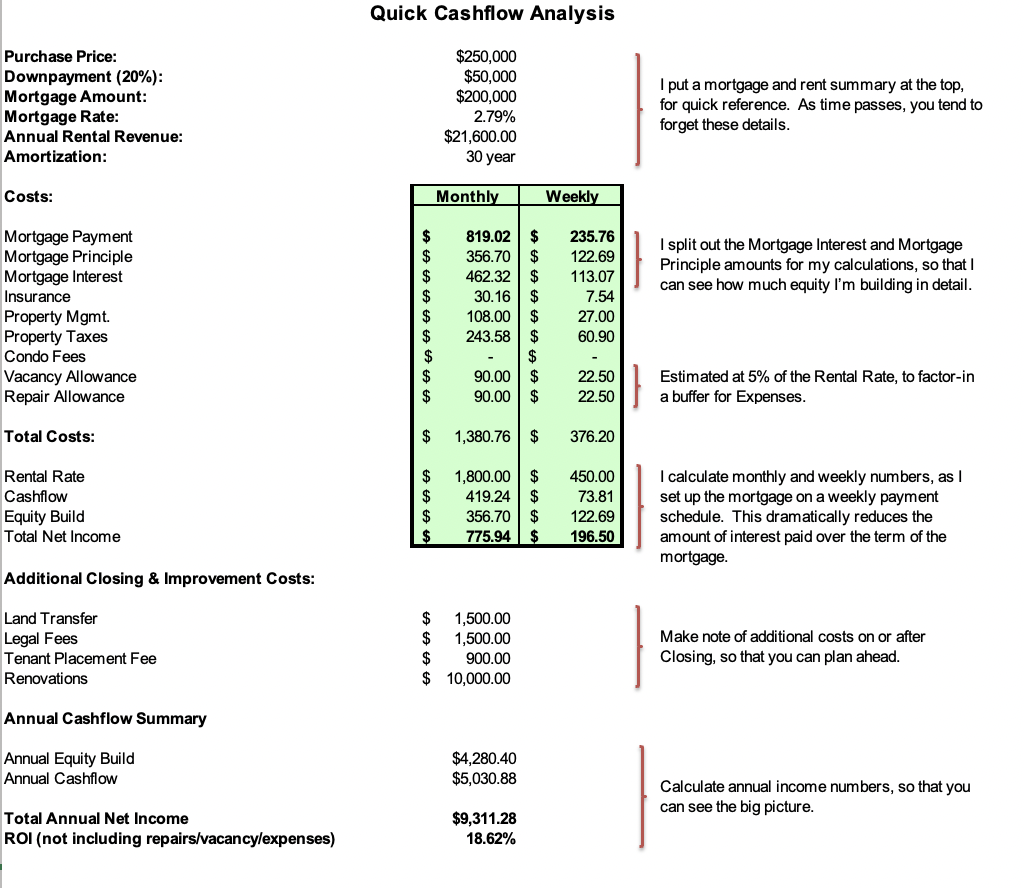

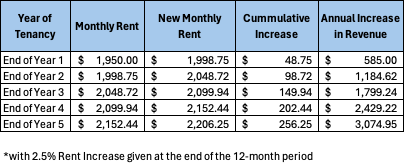

As you can see in the table below, even small rent increases compound over time. This can have a significant impact on the financial performance of the property over the years. The allowable rent increase may not keep pace with the market, but at least you won’t be too far behind.

Tenants expect a Rent Increase

In general, most Tenant expect that the rent will go up each year and accept it. If the Landlord and Tenant are on good terms, then the likelihood of a rent increase causing a Tenant to leave is highly unlikely.

You’ll eventually resent the Tenant

As I mentioned in my own story, the Landlord-Tenant relationship must be mutually beneficial. Fostering a great relationship with your Tenant by not increasing the rent is an admirable quality, but you might eventually resent the Tenant because their rental rate is so low and they have no plans on leaving any time soon. You’ll start feeling like you’re being taken advantage of, even though it was your choice not to increase the rent over the years.

Low risk of losing a good Tenant

The risk of losing a Tenant is low, as they will likely not be able to find anything cheaper. Tenant’s keep a close eye on the market and know if they’re at, above or below the market rental rate.

If they’re generally happy with their rental unit and have good relationship with their Landlord, they are unlikely to look elsewhere. Finding and moving to a new place is costly and time-consuming for the Tenant (plus the risk of getting a bad Landlord). As long as the rent increase is reasonable, it makes more sense for them to stay where they are.

Does a Rent Increase need to be on an annual basis?

No, it doesn’t.

In Ontario, a minimum of 12 months must pass between each rent increase and Tenants must be given 90-days notice using the N1 Form. But that doesn’t mean that you must give a rent increase every 12 months. You can give an increase every 15 or 18 months, if that makes more sense for you.

What about properties that are exempt from Rent Control?

This is where it can get tricky.

In Ontario, most rental units that were built after November, 2018 are not subject to Rent Control. That means that a Landlord is free to increase the rent as much as they want.

In this scenario, we always suggest that the Landlord keep the increase to a reasonable amount, say 5%. This amount seems reasonable to the Tenant, yet still gives a significant bump in revenue to the Landlord.

The challenge we’re seeing today is that because the property owner paid such a high price for the property in recent years, most find it difficult to maintain a positive cashflow. So when the time comes for the annual rent increase, many will base the increase on the carrying costs of the property. We’ve seen rent increases in the range of $300 – $500 per month. Not because the Landlord is spiteful, but because their costs are so high and the property is a financial drain on their personal finances. Unfortunately, for the Tenant the Tenant doesn’t have much choice in this scenario, except to find a cheaper place to live.

Is there a time when you shouldn’t give an increase?

Yes, there are circumstances where it makes more sense to forego the rent increase:

Buyer’s Market

Real Estate works in cycles, so there may be times when supply of rental housing in the area exceeds demand. This can drive rental rates down, which means that Tenants have more options and might even be able to save a few dollars by moving to a less expensive rental unit.

Price threshold

If your current rental rate is at or near the market rate, then you might want to reconsider giving a rent increase. As your rate starts to creep above the market rate, Tenants will naturally start looking for something less expensive.

Catastrophic Events

Events like the recent pandemic or the closing of a local Employer can have a significant effect on the rental market.

In these situations, you should shift your focus to Tenant Retention, as turning a Tenant during these periods would be costly and you’re less likely to obtain a higher rental rate.

In general, we strongly encourage our Clients to increase the rent within the allowable limits annually. The risk of losing a good Tenant is low and Landlords need to do all they can to ensure that they’re not falling behind every year. It’s just good business and beneficial to both the Landlord and the Tenant in the long run.