Real Estate Property Investing 101:

No doubt about it, owning a rental property is an amazing experience and a great way to build wealth over time. It can also be a financial disaster if you don’t take the time to run the numbers before jumping in. This is why a Cashflow Analysis is important to include as an early step.

Understanding and doing a cashflow analysis of a property is critical to your success as an investor. Owning a rental property can be stressful enough. Adding pressure of a property draining your personal finances can push you past your limit. Furthermore, your real estate portfolio must be sustainable and stable enough if you plan to grow it. The alternative will make it very difficult to add additional properties to a money-losing portfolio.

I’ve often seen investors buy a property without knowing the numbers or considering if it makes financial sense to own the property at all. Within months, they’re stressed-out and desperate to improve the situation. Unfortunately, this scenario often ends with them selling the property altogether.

So, what is a cashflow analysis and how is it calculated?

Cashflow Analysis Basics:

Basically, Cashflow is your Net Income…how much of the Revenue (Rental income) is left over after all the Expenses are paid.

A property can be either cashflow positive, cashflow neutral or have a negative cashflow. This simply means it’s either making money, breaking-even or losing money. Basically, a cashflow-positive property puts money in your pocket each month, while a cashflow-negative property takes money out of your pocket each month.

Ideally, most investors want a property to be cashflow-positive. However, this can depend on your situation and your goals. I heard an interesting way of looking the cashflow of a property. If you’re focused on the Cashflow, then you’re an Investor. Alternatively, if you’re focused on Appreciation of the property, then you’re a Speculator.

Of course, we’re all speculators to some degree. It is an inherent assumption that we want our properties to appreciate over time. In the short term however, most of us need to be sure that the property is making money each month. In some rare cases, it’s ok to carry a money-losing property, as long as there is some end-result that will offset the losses. But this is why Cashflow Analysis is so important at the start.

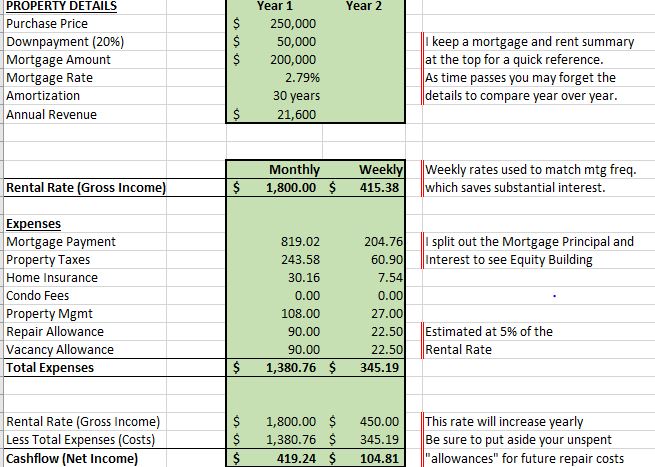

A Quick and Easy Cashflow Analysis

When I first got started in real estate investing, I created a simple spreadsheet. It is designed to run the numbers on each property that we were considering buying. To this day, I still use that same spreadsheet and keep an updated copy for each property that we own. That way, I can update the numbers, when we renew the mortgage, increase the rental rate or the appraised value of the property changes.

This is what it looks like:

Here is a sample of this cashflow spreadsheet you can download now an update as you need.

Why is it important to understand Cashflow?

When buying an investment property, you need to know exactly what you’re getting yourself into. I would say that’s one of the most important fundamentals of real estate investing.

Believe me, if you’re just starting out in real estate, you don’t want a property that is losing money each month. As I mentioned before, owning a rental property can be stressful enough, without the added strain on your personal finances that a money-losing property will have.

Maybe losing $100 or $200 per month doesn’t sound like much, but this can quickly become much worse if there’s an increase in Mortgage Rates. Unplanned repairs can also throw your plan off. As a result, your $200 loss can quickly jump to $1000 or more on a given month. Not a great way to build financial stability.

The great thing about real estate investing, as opposed to other investment vehicles like mutual funds or stocks is that, for the most part, you can calculate your monthly cashflow before even buying. With this knowledge, you shouldn’t have many surprises after your purchase. All of the results are available to you beforehand IF you take the time to run a simple analysis.

By understanding your cashflow, you’re taking the first step in building a solid foundation of wealth. A positive-cashflow property will add to your wealth over time by covering all your expenses with each rent payment. Thereby allowing you to slowly build your equity along the way too. All these gains are now the result of just your original investment. That’s the magic of smart real estate investing!

It is worth exploring the Equity portion of the equation in a future blog. Even this is not the end of the story of your investment! You still have potential appreciation of the property to factor into to this winning combination. Again, this too will require a little more discussion as we need to explore the proceeds, costs and tax liabilities upon property disposition.

But first, in my next post, I’ll discuss some key strategies to maximize and stabilize your cashflow. Until then if you need any support contact me directly.