Finding a great Tenant has become a daunting and stressful task for many Landlords.

With the advent of social media and online forums, we are constantly bombarded with stories of rent arrears, long LTB delays, Cash for Keys, overcrowding and property damage. These stories have almost become urban legend and invoke fear in the hearts of even the most seasoned Landlord.

The thing is, we only hear the horror stories, not the good news stories.

Finding a great Tenant is not always easy, but it’s not as difficult as some would lead you to believe. Tenant recruitment and selection has many dimensions, so is more a matter of following a process and doing the due diligence without cutting corners.

One thing that you might not realize is that your Tenant selection process starts way before you even post an Ad or do a showing.

So, where do you start?

The Tenant Selection Process Simplified

1. Who is your ideal Tenant?

The whole process starts with articulating a clear vision of your ideal Tenant, aka your Ideal Tenant Profile.

Who are you trying to attract? Who would be best suited for the property? What do they do for a living? How many people are you looking for? How many vehicles do they have? Do they have pets?

Create a written description and use it as a guide during your recruitment and selection process. Use your clear vision to write Ads that appeal to your ideal Tenant or Tenants (you can have more than one Ideal Tenant Profile). Compare every application that you receive against your profile and stick to it.

2. Offer a great product

Your Property is your Product and the Tenant is your Customer. If you put a low-quality Product on the market, you’ll attract a low-quality Customer.

Buy a great house in a great area and the great Tenants will line up at your door.

Same holds true for Maintenance. A well-maintained Property will attract Tenants that want the same.

3. Price as a Filter

Do your research to determine the rental price range for your property and area, then start your pricing at the top of the range. A higher price will deter most semi-qualified candidates and make your job much easier. Reduce the price incrementally, depending on response to your advertising. Ultimately, the market will determine the rent, but you will avoid wasting time with unqualified applicants.

4. Create great Ads

Your goal is to generate as much awareness about the property as possible. At the time of this writing, Facebook Marketplace is a highly effective method of reaching the rental market. MLS (Realtor.ca) is also an option, which expands your market exposure, but at a higher cost. High-quality lawn signs can also be effective, depending on the location of the property.

In terms of information about the property: More is Better! Nothing is worse than looking at a property listing that tells you absolutely nothing about the property. It’s an indicator of a lazy, low-quality Landlord. What kind of Tenants do you think this will attract?

High quality photos are critical and a video walk-through can be effective as well. An effective advertising strategy is to publish 2 versions of your ad: one that lists the point-form features of the property, and one that describes the benefits of the property. Each version will appeal to readers differently.

Include a line of text at the bottom of the Ad stating: “First and Last Month’s Rent, Credit Check, proof of Income and Photo ID required”. This will instantly discourage less-qualified candidates from responding.

Keep it Legal. Your ads should not discriminate in any way and cannot include any requirements that contravene the Residential Tenancies Act (e.g. ‘No Pets’). Doing so just looks unprofessional and can be a deterrent for your ideal Tenant.

Make it easy for potential tenants to get in touch with you. If you are comfortable, provide a phone/Text number and email address within the text of the Ad.

5. Respond quickly to enquiries

It’s important to stay on top of your Ad responses and contact the potential candidate as soon as possible, meaning minutes or hours, not days. Their interest in your property is fleeting, as they might also be responding to 20 other Ads. You’ll find that about 30% of incoming inquiries will go nowhere, as they have likely made contact with another Landlord by the time that you reply and you will not hear back from them.

If possible, try to make verbal contact or at least correspond by text with the candidate if they messaged through social media. This increases your chances of booking a showing and you can also tell a lot about the candidate by their mannerism on the phone or through text message (another filter!).

6. Pre-screen Candidates for Showings

If your property is likely to garner a flood of interest, then you should consider pre-screening the candidates before showing them the property. This will save everyone a huge amount of time and effort. No point in showing someone the unit if they don’t meet the criteria from your Ideal Tenant Profile. It’s all about efficiency and you need to focus on the most-qualified candidates.

One of the easiest and most effect pre-screening tools is a Google Forms questionnaire. Once you create the questionnaire, embed a link in your Ad copy, with a short sentence saying that the candidate must fill out the form to request a showing. Learn more about Google Forms here: https://www.google.ca/forms/about/

7. Conduct Showings and establish rapport

In our opinion, the in-person meeting, aka Showing, is one of the most critical pieces of the Tenant selection puzzle. Without being overbearing and intrusive, you should strive to establish a rapport with the candidate and facilitate a friendly conversation. This will put the candidate at ease and encourage the flow of information. As you build trust, they will open up and offer more insight into their story and character. Most often, you’ll get a gut feeling about the candidate during that first meeting. If you have a bad feeling about the candidate, pay attention, as that first gut feeling is usually correct.

8. Application and supporting documents

If a candidate wants to proceed with renting the property, the next step would be to have them fill out an application and submit their supporting documents.

You should request:

- A Rental Application – filled out completely, without missing information

- Photo ID of all Leaseholders

- Proof of Income – recent Pay Stubs and/or Job Letter – for all Leaseholders

- A recent Credit Report – PDF version (no screenshots), one for all Leaseholders

This is where the process can bog down. You’ll encounter many applicants that are not IT savvy and can have challenges with obtaining and sending documents. You’ll also encounter applicants that don’t have the documents readily available, even though your Ads clearly state that they are required. Navigating this can take some patience, as it can be a lot of back and forth until you have everything that you need. (One note: the fact that it’s so difficult to get the documents from them can be a red flag and an indication of what it will be like to deal with them as Tenants).

9. Do-do-do the Due Diligence

Once you receive all of the requested documents, then the work begins. The due diligence phase is the most important part, as it’s your last line of defence against all the horrors that you read about on social media.

This seems obvious, but you’d be surprised by how many Landlords take the short-cut and accept the applicant on face value. There are many reasons that they do this:

- They’re under financial strain and desperate to get the unit rented.

- They don’t have the time for due diligence.

- They don’t know how to properly screen a Tenant.

- They don’t know what supporting documents to ask for.

- The Tenant offers a lump-sum payment up-front as incentive, usually to overlook red flag on their application.

- The Tenant was referred by a friend, acquaintance, or family member.

- The Tenant offers to do repairs/improvements to the property, usually for a rent discount.

- The rental unit is of low-quality and/or in a bad area.

- They feel sorry for the Tenant’s situation and want to help them out.

In most cases, things start out just fine, but eventually start to slip. The Tenant starts paying late, then missing payments, then not communicating. The Landlord doesn’t handle the situation properly and the downward spiral begins…

This whole situation could have been avoided by doing the due diligence (aka Application Process, Background Check, Tenant Screening, Vetting Process), no matter where the candidate came from or what their story is. It doesn’t matter if they were referred to you by a co-worker or family member, always run them through a vetting process. It doesn’t matter if the Tenant entices the Landlord by offering to pay for one year up front (happens all the time and is a major red flag!), do the due diligence.

This might seem extreme and uncomfortable in some cases, but owning a rental property should be ran like a business. Your rental business. And like any business, it depends on consistent revenue to make it work. You’re also handing over a property worth hundreds of thousands of dollars to a stranger. You need to make sure that the person taking possession of your valuable asset is qualified and trustworthy and that you feel good about it (that Gut-feeling).

So, what’s the best way to screen an applicant?

- What’s your impression after meeting with them in-person for a showing?

- Call References, especially their Employer.

- Social Media checks – how they behave on social media says a lot about a person.

- Social Media checks on their References, especially their Employer and Supervisor.

- Confirm Credit Score on platforms such as Front Lobby and SingleKey – Tenant-provided Credit Reports can be easily falsified – happens all the time.

Through all of these checks, you should be looking for ‘Red Flags’, such as:

- Inconsistent, missing or false information.

- Dragging their feet on giving you the information that you requested.

- Not being able to find them or their employer on social media.

- Employer not calling you back for a reference check.

- Not providing previous Landlord contact information.

- Mismatched fonts on pay stubs or other documents.

You also want to assess:

- Their ability to pay – do they have enough income to cover their expenses?

- Will they be a good fit for you, the rental unit and other Tenants (say, in a multi-unit building)?

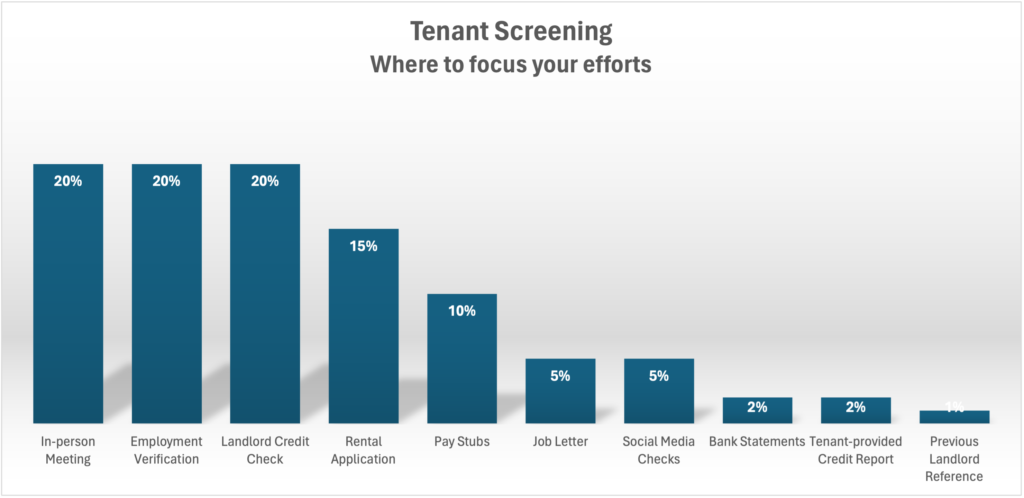

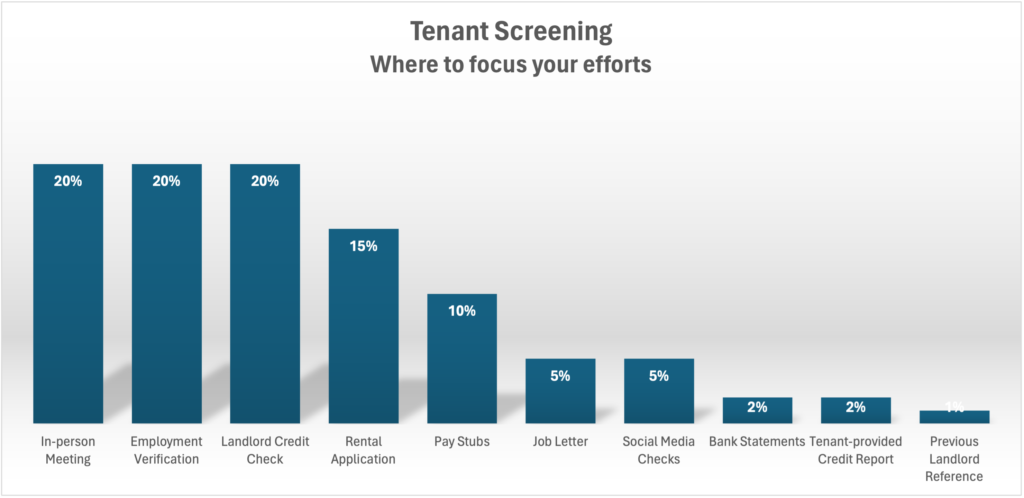

The graph below is not overly scientific, but it shows where we focus most of our efforts during the due diligence process. In most cases, the information and documentation that the applicant provides are legitimate, but it’s important that you double-check through your own validation process. Rental Fraud is becoming more prevalent and sophisticated due to the advent of technology, so it’s good to develop a process to reduce the chances of being scammed.

9. Make a decision with confidence

If you’ve taken the time to assemble the appropriate documents and check their validity, then your decision will likely be easy. You should also have a good feeling about the applicant after meeting with them in-person and dealing with them through the application process. As I mentioned before, be aware if you have a nagging feeling that something isn’t quite right. Trust your gut…it’s called intuition and it’s usually right.

Your ultimate goal

At the end of this process, you want to feel good about the choice that you’ve made. You want to select someone who will be a pleasure do deal with on a day-to-day or monthly basis. You want someone who’s not going to be overly needy or helpless, as that will eventually be drain on your time and energy. You want a stable Tenant that will provide stable income for you.

To accomplish this, you need to trust yourself and trust the process. Put in the work of checking the facts and listen to your intuition if something doesn’t seem right.